Of course the first question is “How can you afford this?” We approached the financial problem from two angles. First, we worked on reducing all the costs we could while we live in the US. The biggest thing we did to accomplish this was to radically downsize our home and move to a less expensive area. I’m writing this like it was a simple decision, but it was a really hard thing to do. I loved my house in Northern Virginia. I had friends in town. I was happy and comfortable. But we were working very hard to make enough money to afford a house way bigger than we really needed in a very expensive area. We were spending our free time maintaining this big house. Simply put, while we loved our house, the house was owning us.

By moving from Northern to Central Virginia to a much smaller house, we cut our property taxes by 80% and the principle and interest payments on our house by 84%. Car insurance is cheaper. Gas is cheaper. Because we work digitally now, we’re not buying career clothing, we’re not commuting and we’re not eating lunches out. Actually, at our base home we rarely eat out now at all, especially compared to when we were working full time. We dropped cable TV. We’ve considered getting rid of one of our cars, and while we’ve not yet done that, it’s a viable option.

Remember, we’re still working, though Al’s schedule is about half time and Sue’s is about third time now. Some of you might need to work a little more, some a little less, and some lucky ones out there might not have to work at all. Al retired as a Colonel in the Air Force, so we have military retirement and the health care that goes with it. We’ve made some good investments. We are also frugal people. We’re not interested in designer clothing, fancy cars or the latest gadgets. (except for Al and his bike!) We are still bringing in an income with Al’s teaching and consulting and Sue’s writing, work which can be done anywhere. With careful management, we’re finding that this lifestyle is possible!

The other angle is how much we spend while we’re nesting abroad. Nesting abroad costs us travel fare, rental for our flats and additional fees and costs for touring. We simply wouldn’t go to as many museums, attractions and even restaurants in a three month period at home. So we’ve researched ways to keep those costs down as much as possible. We’ve found that if you are careful about where you go, and when you go there, the costs can be quite reasonable. Some destinations are downright cheap! An interesting site to study while you are choosing destinations to nest is Expatisan. Expatistan compares the cost of living between any two cities in the world, and the results can be quite surprising – and gratifying! For example, one of our destinations, Krakow, Poland, has a cost of living 40% less than Charlottesville, VA, the closest city to our Virginia home. On the other side, there are some destinations that are simply out of our reach. One of the primary reasons we went to York, England instead of London was cost. We would love to nest in New Zealand, but the cost is simply out of budget, unless we get lucky and score a great house-sitting gig or something similar.

Negotiating the cost of your nesting flat is one of the best ways to keep costs down. Especially if you start with HomeAway or AirBnB, it is perfectly reasonable to negotiate when you’re looking to rent a flat long term in the slower seasons. In some locations it is possible to get discounts up to 50% off the published rate on AirBnB or HomeAway with negotiations during the slow seasons. Our best reduction has been about 45% off, but it really depends on location and the time of year. Check out our page “Finding your Nest” for more information on the negotiation process.

If you are able to book a flat in an area where you won’t need a car, you’ve saved yourself a huge amount of money, in car rental, in parking and in gas. The cost of having a car is the one area where nearly every foreign location is significantly more expensive than the US, so if you can eliminate this, you’ll really make a big difference with your budget. This will mean finding either a place that is within walking distance to the sights you’ll want to explore the most, or along public transportation routes. You can always rent a car for the day if you want to explore places outside your city that you can’t get to by train or bus – and if you return it that night, you can avoid the parking nightmares that are a real fact of life in so many cities. (another reason not to rent outside the city and drive in – you often won’t be able to park your car when you get there!)

Of course, you want to book your airline tickets enough in advance that you can take advantage of lower rates. If you’ve flown with any regularity, you know that certain days and certain times are more economical, and we try to take advantage of those. Everyone has their tips for saving on airlines, from using miles to booking with supersaver websites like Skyscanner.

One of the ways we really cut costs when we nest is by eating at home. Of course, one of the great things about travel is trying the food, but we mostly do that by exploring the food markets and cooking their foods in our apartment. There’s a big cost difference between restaurant meals and home-prepared meals, especially in tourist towns. I’ve tried to learn to cook the cuisine wherever I am – I had a great time learning how to make pasta in Italy (with my dad!) Buying and preparing the local food is also a lot less expensive and ultimately more satisfying, rather than trying to recreate your favorite meals from the US. It’s amazing how expensive a box of Kraft Mac and Cheese can be in the “import” section of a grocery store – and there will be other options you’ll like just as well, if not better! When we do eat out, we really avoid the tourist areas and the places where the menus are translated to numerous languages. We look for authentic family restaurants in the areas around our flat, and are generally rewarded by good food, decent prices and friendly service. Very often, our food costs are less than if we had stayed at home, sometimes significantly so.

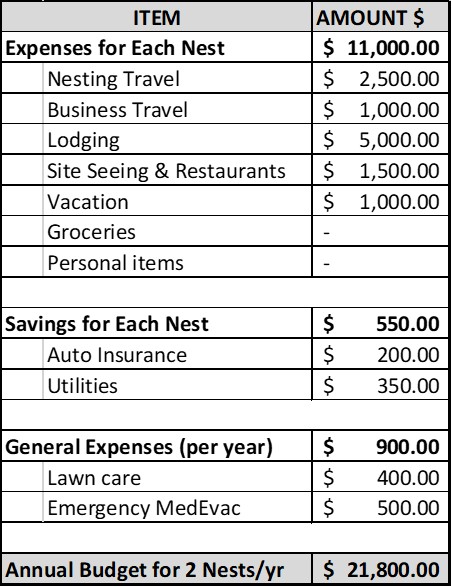

We made up a budget of how much we can afford to spend per month of nesting. Of course, any reduction of our costs in our home base cost allows us to increase the nesting budget, so it’s a balancing act between our home in Virginia and our homes around the world. We budget $11,000 for each nesting (~$22K/yr). This includes our flat, extra touring expenses, travel expenses and lawn care while we’re away. It does not include food, because we have to eat wherever we are. (Remember we always rent a two bedroom flat – you can reduce that amount by getting smaller apartments.) Of course, some places are more expensive than others, so we try to balance them – if we splurge on a more expensive location, we then temper it by going to a less expensive place next to even it up. The thing we’ve discovered, though, is that the cost of a place doesn’t really relate to how much we enjoy it. The less expensive places are just as enriching and exciting.

We summarized our budget on a table. To achieve the car insurance savings, we call our insurance company each time we depart and then when we return, informing them that we “garaged” our cars. The utility savings are probably conservative, but the shoulder seasons consume the least gas and electric – compared to summer & winter.

These costs are largely offset by downsizing and budgeting at our home base. One final insight on savings is about vacations. We tag a week onto the start or end of our Nesting. It’s part of our 90 days abroad so usually take a train somewhere not far away. On the other hand, we no longer vacation when we are in the USA except to visit families. We did not include our vacation savings in our budget table — perhaps we should. Your prior vacations expenses might be different from ours, but we suspect that if nesting abroad interests you, then you probably would save many thousands of dollars by no longer paying for typical traditional vacations.